pay personal property tax richmond va

Pay another PP Bill. Is more than 50 of the depreciation.

Super Smart Ideas For Your Income Tax Return Income Tax Return Tax Return Income Tax

Personal Property Registration Form An ANNUAL filing is required on all.

. The vehicle must be owned or leased by an individual and not used for business purposes to qualify for personal property tax relief. To mail your tax payment send it to the following address. Personal property taxes are due May 5 and October 5.

Historically vehicle values tend to depreciate from month to month. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. City of richmond 2019 and newer property taxes real estate and personal property are billed and collected by the ray county collector.

Personal Property Tax Rate. Portsmouth levies a personal property tax on vehicles boats aircraft and mobile homes. Please call the office for details 804-333-3555.

Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA value at a rate of 500 per 10000. To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Offered by City of Richmond Virginia. View Bill Detail Screen. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 7501 pounds. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes. COVID-19s Impact on the Vehicle Valuations of 2021 Residents may experience a higher personal property tax on vehicles this year due to changes in the market.

If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen. City Code - Sec. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed.

View payment information for personal property taxes. The Treasurers Office has several ways you can pay. Is more than 50 of the vehicles annual mileage used as a business.

If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen. Personal Property Taxes are billed once a year with a December 5 th due date. FOR IMMEDIATE RELEASE April 18 2022.

- Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soonYou have until Monday May 2 2022 to submit your returnTaxpayers can watch a new video on filing options follow us on Twitter or Facebook for. Personal Property Car Tax Relief. Yearly median tax in Richmond City.

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. Richmond County Treasurers Office. Your tax account number which is located in the upper right corner of each tax statement.

When a person initially acquires an automobile or truck andor moves that vehicle into Henrico County that person must file a personal property return. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. Personal Property Tax.

When you use this method to pay taxes please make a separate payment per tax account number. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. View Bill Detail Screen. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button.

Learn all about Richmond real estate tax. Other Useful Sources of Information Regarding False Alarm Fees. Pay another PP Bill.

Pay traffic tickets that you may have received in. Pay bills or set up a payment plan for all individual and business taxes. You can pay your personal property tax through your online bank account.

Pay Personal Property Taxes. When do I need to file a personal property return for my car or pickup. A license is required for every cat or dog residing in the city as soon as they reach four months of age.

Norfolk residents can gain information on paying real estate taxes. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button. Pay personal property tax richmond va.

Make tax due estimated tax and extension payments. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. The assessment on these vehicles is determined by the Commissioner of the Revenue.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. To visit the site register your alarm or make a payment visit Cry Wolf.

Virginia Property Tax Calculator Smartasset

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Bat Dong San Va Xay Dung Skyscraper Civil Engineering Real Estate Marketing

Understanding Your Credit Score Nfm Lending Credit Score Understanding Yourself Understanding

Pay Online Chesterfield County Va

Richmond Va Metro Area June 2021 Real Estate Market Update In 2021 Real Estate Marketing Real Estate First Home Buyer

Virginia Llc How To Start An Llc In Virginia Truic

Http Www Nicholsonolson Com Https Plus Google Com 100311491973099033070 About Hl En Accounting Services Accounting Jobs Accounting And Finance

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Real Estate Tax Frequently Asked Questions Tax Administration

Spousal Support Lawyers Wisconsin Divorce Attorney Family Law Attorney Divorce Lawyers

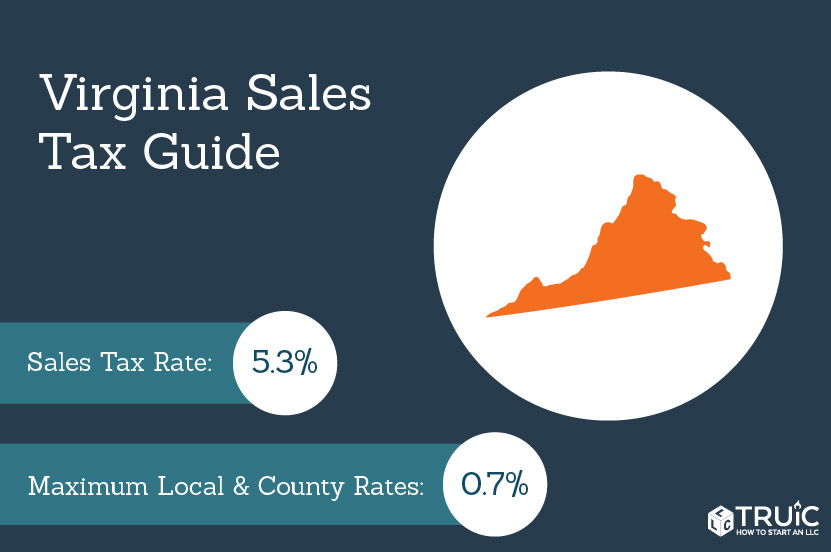

Virginia Sales Tax Small Business Guide Truic

Lowering Auto Insurance Rates Stretcher Com Save Money No Matter What Your Credit Score Autoi Cheap Car Insurance Getting Car Insurance Car Insurance Tips

Pay Online Chesterfield County Va

Taxmaster Finance Consulting Psd Template Psd Templates Finance Psd

Taxes When You Sell Your House In Virginia Avante Home Buyers

.png)